Through the PSFU-implemented GROW project (which in full is Generating Growth Opportunities & Productivity for Women Enterprises), the government of Uganda, with support of the World Bank, continues to support women-owned/operated business enterprises to grow, expand and even diversify into new areas.

Every woman-owned/operated business is eligible to (at the interest of just 10% per annum) borrow up to between Shs4m and Shs200m. Even co-owned businesses, in which women own or control up to 51% shareholding, qualify to borrow money and receive other forms of support like training, skilling and certification under the GROW project.

There are three levels for GROW project loans namely level one (4-20m), level two (20-40m) and level three (40-200m). Funded by World Bank and implemented by the GoU, GROW is a five-year project worth $217m, which comes to Shs850bn in Ugandan money.

It mainly targets to benefit women entrepreneurs who are already engaged in some form of economic activity and aren’t poor enough to qualify under PDM. There is also emphasis on supporting female refugees and other women entrepreneurs in refugee-hosting districts. At least 5% of the money and all the other opportunities deriving from GROW are preserved for female refugees and women in refugee-hosting districts.

Both already existing and newly-incorporated women-owned business enterprises are eligible to benefit. Some of the women enterprises had been existing but without ever engaging with or accessing formal credit from financial institutions.

Through GROW project, such female entrepreneurs are enabled access to formal credit for the first time, which amplifies the government of Uganda’s policy of deepening financial inclusion. Beneficiaries are also enabled to access larger amounts of credit to facilitate expansion and diversification of their already existing business enterprises.

PROFILING THE IMPACTED BENEFICIARIES

As we illustrate in the following reporting, several individual women entrepreneurs have already been impacted and have been able to expand and diversify their businesses-courtesy of the GROW project loans. Beneficiaries are mainly from Greater Kampala Metropolitan Area and other regions of Uganda like Greater Masaka, Acholi, Lango, Busoga and Ankole etc.

The disbursement of the funds, which must be utilized within the designated period of five years, is being effected by the six Participating Financial Institutions (or banks) which were selected through a very competitive process. They include Centenary, Finance Trust Bank, Post Bank, Equity Bank and Stanbic.

Besides Pride Microfinance, Opportunity Bank and a few selected SACCOs (like UGAFODE, CBS PEWOSA etc) whose inclusion the President directed not very long ago, these six PFIs are mandated with operationalizing the GROW Financing Facility (GFF) out of which all these project loans continue being disbursed.

From the reviewed literature, it’s clear that the GROW project overall objective is to increase access to entrepreneurial services that can enable women entrepreneurs grow, expand and diversify their business enterprises.

INTRIGUING STATISTICS:

On average, 40% of the beneficiaries of the GROW project loans are first time borrowers; with 62% of the borrowers being married people compared to 30% who are single mothers and 4% who are widowed or divorced.

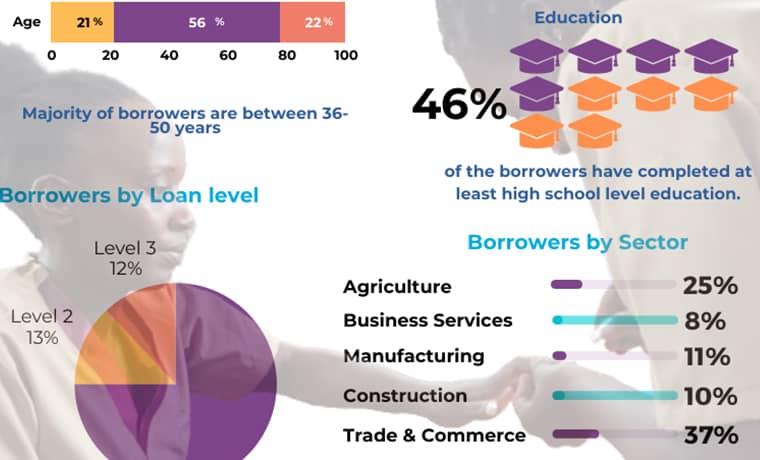

The other interesting demography that merits being noted is that majority of the borrowers (actually 56%) are aged between 36 and 50 years. 21% are aged 18-35, and 22% are aged 50-75 years. And as of last December, for education level, 46% of the borrowers had at least completed S6/UACE.

Looking at sectors, as of last December, 25% of the beneficiaries who borrowed and took out the money were in agriculture-related business enterprises, 8% in business services, 11% in manufacturing, 10% in construction, and 37% in trade & commerce.

Level one borrowers (taking out between Shs4m and Shs20m) are the majority, accounting for 75% of the monies disbursed as of last December. Level two borrowers (20-40m) accounted for 13% and level three (40-200m) accounted for 12%.

WHO TOOK OUT WHAT?

Under agriculture (comprising of crops, livestock & poultry), some of the GROW project loans beneficiaries include Sarah from Masaka. A poultry farmer for now five years, Sarah had all along been a customer of Finance Trust Bank but had never engaged with institutionalized formal borrowing.

Leveraging the GROW Financing Facility (GFF), Sarah took out a loan of Shs10m with a repayment period of 1.5 years (18 months) at the interest rate of 10%. She says she utilized the money by building new shelter for her chicken. She also purchased 800 additional birds on top of buying vaccines and stocking more chicken feeds.

She is optimistic that this GROW-enabled recapitalization will double her monthly income to Shs3m. The loan was secured using collateral she jointly owns with her husband. She also had two guarantors of the loan.

THE OTHER BENEFICIARIES:

Using her Namiro Wakiso plot of land as collateral, Christine from Greater Kampala took out a loan of Shs10m to replenish her poultry feeds-making business, which has been a going concern since 2019 when she first founded it. She says she has organically been growing her business as opposed to rushing.

Lack of affordable credit had slowed her progress but with the GROW loan of Shs10m, she has been able to expand her poultry feeds production business by purchasing additional and more sophisticated feeds mixing machines. She is optimistic that her business is going to spectacularly grow to levels she had never imagined.

She has a whole year to repay GROW’s Shs10m with an interest of just 10% compared to commercial banks whose interest averages 20% and more. She is a customer of Equity Bank but always feared taking out bank loans because of the prohibitively very high interest charged.

Prior to the GROW loan, she had previously taken out a loan of just Shs1m from her bank, and not more because she was intimidated by the interest and repayment period, which would be unreasonably short.

Masaka piggery and coffee farmer Rose is another beneficiary of the GROW project loans under the agriculture category. She is a Centenary Bank customer and has been a coffee and pigs’ farmer since the year 2019. She employs seven employees on permanent basis and always hires a few casual laborers to boost her labor force whenever it’s the rainy season.

Using the Shs20m loan received under GROW, Rose has been able to purchase an irrigation scheme unit, fertilizers and insecticides to boost production capabilities and productivity at her coffee farm in Masaka.

The female entrepreneur, who previously had ever taken out a Shs10m loan from Centenary Bank, presented her coffee farm land title as collateral to secure the Shs20m loan from GROW project.

Her brother, who is a co-owner of the land, wrote for her a recommendation letter indicating his consent to their jointly-owned land being used as collateral. She also had two other guarantors signing up to strengthen her loan application.

Mbarara’s Maureen, a dairy farmer, is full of praises for GROW project for having enabled her to remain strongly competitive in the dairy farming arena, which she says has always been a male-dominated business. She has been at it for now 12 years, having started out with four bulls and three cows.

Her resilience has gradually paid off because, as of today, her herd has grown into something very formidable and dairy farming has now become the sustainable source of income for her family.

A pre-existing customer and borrower with Centenary Bank, Maureen was given a loan of Shs10m from the GROW Financing Facility and was given a whole two years within which to pay back. She invested GROW’s Shs10m to increase on her dairy farm’s productivity by purchasing two high-yielding dairy cows.

She is optimistic that in the long term, this will increase her overall income as a dairy farmer. For collateral, she used her cattle and the sales agreement for her land.

She is grateful to the GoU and its partner, the World Bank, for coming up with GROW project in order to emancipate women entrepreneurs.

Versatile entrepreneur Charity of Masaka is another GROW project beneficiary. Since the year 2020, she has been into the broiler poultry business and employs one other person. With support from GROW, she has been able to diversify into commercial tailoring as an additional business activity.

The Post Bank customer had in the past ever taken out a loan of Shs15m and is grateful for the Shs10m loan that was given to her under the GROW project. She is super grateful for the interest of 10% and the repayment period of 1 year.

Besides diversification, Charity used some of the money from GROW to replenish and expand her poultry business and to also re-establish herself as a coffee farmer. For collateral or security for the loan, Charity gave in the sales agreement for the land on which she operates. The good thing was that the land isn’t co-owned, she owns it alone.

There is also Regina, a bananas, pigs and goats farmer in Masaka. She employs two other people, besides herself. The same female entrepreneur also previously owned a furniture shop, which she has since bequeathed and passed on for her children to manage in Kampala.

She is a customer of Centenary Bank from which she had previously contracted two loans-one of Shs9m and another of 20m. She is grateful for the Shs10m that was lent to her from GROW. She utilized the Shs10m by investing in value addition to improve on the quality of banana growing at her farm in Masaka.

She used part of the money to purchase fertilizers and to also go into coffee farming by establishing a coffee farm. She is hopeful that within the 12 months repayment period for GROW project loan, she will have sustainably established herself as a more viable diversified farmer of both coffee and bananas than she has ever been.

She leveraged her kibanja sales agreement and two guarantors as collateral/security to secure her loan from GROW. She is grateful that the process wasn’t as stressful and as bureaucratic as she had previously encountered while trying to borrow from the bank whose other more conventional loan products tend to be more complicated.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article