In a series of developments this week, the Uganda Police have absolved Equity Bank and Stanbic Bank of any wrongdoing in the case of a Canadian national, Clifford Max Potter, who reportedly lost over UGX 3 billion (approximately USD 1 million) in a fraudulent gold transaction between 2016 and 2019.

Background of the Case

The case centres around Clifford Max Potter, a Canadian citizen, who entered into a gold transaction with Stephen Bairukanga in 2016. Potter agreed to pay substantial sums of money to Bairukanga’s account at Equity Bank Uganda for the purchase of gold. The payments, totalling approximately USD 1 million, were made over a period from 2016 to 2019.

Potter’s legal representatives, Muwema & Co. Advocates, detailed that despite the substantial payments, Potter never received the gold he was promised. Upon realizing he had been defrauded, Potter sought to recover the funds but was unsuccessful in his attempts. Early this year, Potter, through his legal team, wrote to Equity Bank and Stanbic Bank demanding a refund of his money, alleging that the banks had failed to prevent suspicious transactions and did not adhere to proper anti-money laundering (AML) procedures.

Equity Bank, through its compliance team, asserted that all AML procedures were strictly followed. The bank obtained necessary approvals from the Financial Intelligence Authority (FIA) of Uganda and complied with customer due diligence (CDD) practices, which are designed to detect and report any AML violations. These procedures are in line with both national and international regulations aimed at preventing the concealment of criminal proceeds within the financial system.

Police Involvement and Investigations

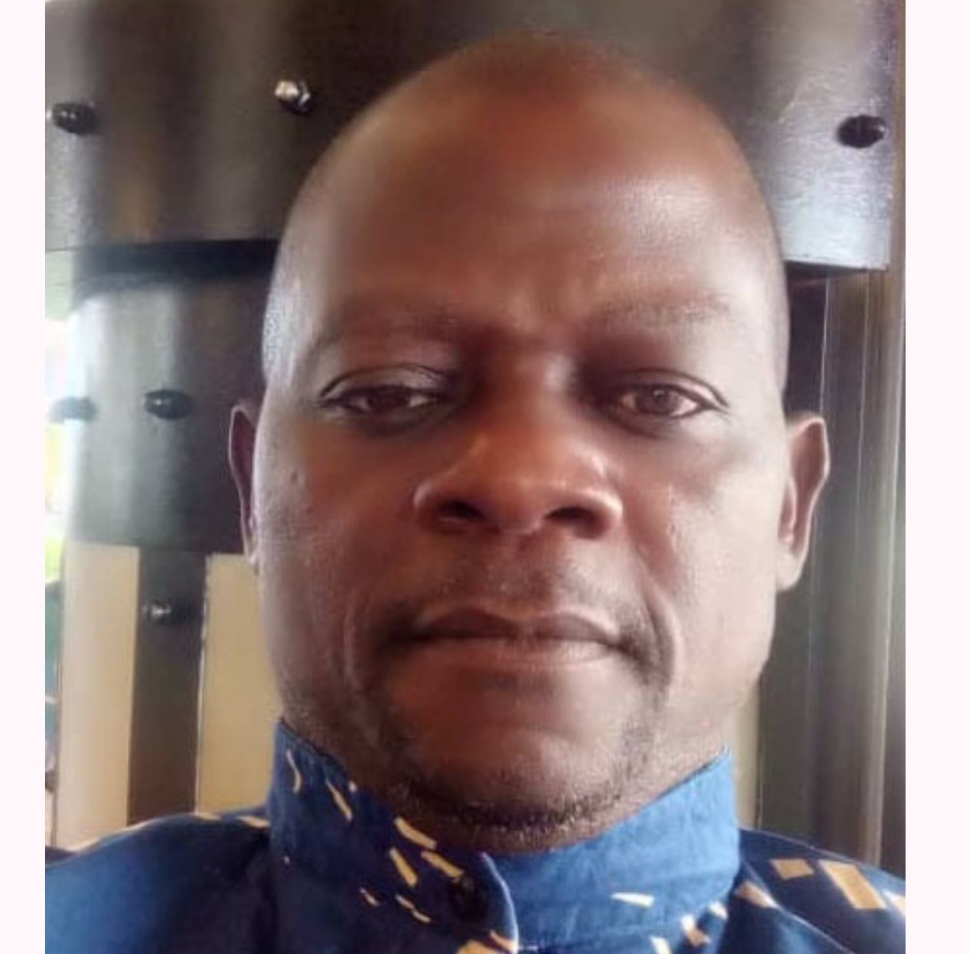

The issue escalated in June 2024 when Muwema & Co. Advocates involved the Uganda Police, requesting an interview with the banks to discuss the allegations. The police, led by Senior Superintendent of Police (SSP) Ayub Waisswa of the Criminal Investigations Directorate (CID), conducted further investigations into the matter.

On July 10, 2024, Equity Bank’s compliance team provided evidence and further clarity to the Uganda Police. The bank submitted documentation proving that due diligence was conducted beyond what was required. This documentation played a crucial role in clearing the banks of any wrongdoing.

Following a thorough review of the case, the Uganda Police concluded that both Equity Bank and Stanbic Bank had adhered to all necessary AML procedures and were not at fault for the loss of funds. The police acknowledged that the banks had complied with all legal requirements to prevent suspicious transactions and had acted within the framework of established AML regulations.

SSP Ayub Waisswa stated, “Our investigations have shown that Equity Bank and Stanbic Bank followed all required procedures. The loss of funds is attributed to the fraudulent actions of individuals involved in the gold transaction, and not due to any failure on the part of the banks.”

The resolution of this case highlights the importance of stringent AML and CDD procedures in the banking sector to prevent financial fraud and protect customers. As for Clifford Max Potter, the focus now shifts back to recovering his lost funds through legal means against the individuals who orchestrated the fraudulent scheme.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article