By Andrew M. Mwenda

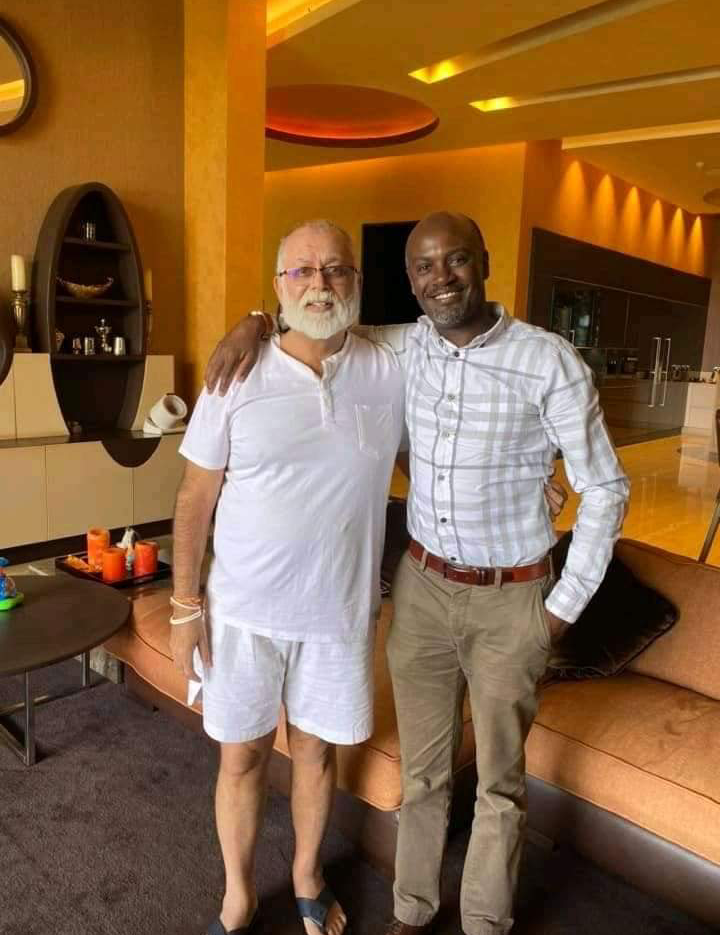

On February 11, businessman Dr. Sudhir Ruparelia won yet another victory in the Supreme Court against Bank of Uganda over the fate of Crane Bank.

The central bank closed Crane Bank in October 2016 claiming it was undercapitalised. The latest ruling is a culmination of a running battle between the central bank and Sudhir for four years. The Supreme Court ruled that Crane Bank should revert to Sudhir and asked BOU to pay the costs. So far it is estimated the costs of the trial from the High Court through the Court of Appeal up to the Supreme Court amounts to Shs 200 billion.

The sale of Crane Bank to DFCU will go down in history as the most fraudulent transaction by BOU. From the very beginning the transaction was shoddy.

The details of the sale of Crane Bank to DFCU Bank are contained in the Purchase of Assets and Assumption of Liabilities Agreement or P&A. When selling a failed bank, the buyer assumes all liabilities (deposits). This requires the seller (BOU) to give the buyer assets equivalent to the liabilities. The buyer looks at the list of assets and chooses those that are good to purchase. If the value of the good assets exceed the liabilities, the buyer pays to the seller the difference and vice versa. We have a precedent.

In 2014 when BOU sold Global Trust Bank to DFCU, there was a list of the value of all assets (good and bad loans) and the value of liabilities (deposits) clearly stating who took what and who owed who money. In regard to the difference in the value of liabilities assumed and assets purchased, BOU paid Shs 2 billion to DFCU. This then became a claim by BOU on the assets of Global Trust Bank in liquidation. They had an appendix to the P&A dealing with assets in escrow, which were the bad book. This appendix mandate DFCU to collect on those assets on a commission basis

In the case of sale of Crane Bank, the P&A did not mention the value of liabilities the buyer was assuming or the value of assets the buyer was buying. This must be the first and only sale agreement in history that does not mention the price of what is being sold. The only inference we can get from the agreement is that it assumed the assets equaled the liabilities. The P&A talks about excluded assets like insider loans, tax credits etc. (Crane Bank had a tax credit with URA worth more than Shs20 billion, which Sudhir can now claim). BOU mentions the bad book of Crane Bank was Shs556 billion but does not say it is part of the purchase.

Let me emphasize that the problem with the Crane Bank sale is that the P&A does not make any reference to any price of anything. Ideally, the P&A should give a listing of assets being taken over by the buyer and the liabilities the buyer has assumed. This is the only way to set the price and establish who owes the other. With Crane Bank, there was no list of assets liabilities and their valuation. How then did they arrive at the value they were selling?

Then there was a separate agreement or an appendix to the P&A which said DFCU would reimburse BOU Shs200 billion out of the money (Shs478 billion liquidity support) Crane Bank owed BOU. Yet in the BOU suit against Sudhir in 2017, BOU asked the businessman to pay for the entire Shs478 billion liquidity support. So they wanted to have it both ways: get DFCU to pay them the same money they wanted Sudhir to pay.

Meanwhile, BoU asked DFCU to pay the Shs200 billion over in ten quarters or 30 months (two and a half years) but did not charge any interest. Why? Later there was an audit of BOU by Ernest & Young which said by 2019, BOU had forgone interest of Shs29 billion. In the 30 months, BOU lost Shs40 billion in interest. Meanwhile, the majority shareholder in DFCU brought in $50 million (equivalent to Shs200 billion at the time) and bought treasury bonds on which BOU was paying interest of 15%. Being the majority shareholder in DFCU, they presented these bonds to BOU as collateral for the Shs200 billion interest free loan to buy Crane Bank. Essentially, BOU was owed Shs 200billion without interest, but the collateral for it earned interest of Shs40 billion.

Yet on July 27, 2016, BOU had written to Crane Bank saying it had a capital shortage of Shs87.42 billion. Sudhir had asked for time to raise the cash and recapitalise the bank. BOU refused. Sudhir then asked for a loan from BOU at 5% and the central bank refused and said it would charge 16%. Instead, it imposed wide ranging restrictions on Crane Bank operations – stopped it from issuing new loans, over drafts, bid bonds, letters of credit, credit cards, performance guarantees etc. that the bank could not operate at all.

I personally attended most these meetings and was frustrated at the intransigence of the central bank in its determination to liquidate Crane Bank. I warned BOU officials that their restrictions would cause a run on the bank, leading to a liquidity crisis. And this is what exactly happened – BOU filled it with Shs478 billion where it could have lent Crane only Shs87 billion. In fact, within six months Sudhir had given BOU $16 million (Shs50 billion), demonstrating that the Crane Bank capital problem as easy to solve.

It is then that I learnt the real intentions of BOU officials was to wreck the bank and steal Sudhir’s personal assets. Indeed, the first signs came during statutory management. Crane Bank was spending Shs8 billion per month as operating expenses. But under statutory management, BOU was spending Shs40 billion per month, an extra Shs 32 billion. Where was this money going? That was the beginning of the robbery. After passing the bad book to DFCU for free, BOU transaction advisors on the sale were hired by DFCU as collection agents on it. In the first 6 months, they collected Shs56 billion and took hefty commissions.

Under the Confidential Settlement and Release Agreement (CSRA) between Sudhir and BOU, the businessman paid $8 million from his Dubai account straight to BOU. It is BOU legal department that drew up the CSRA. However, BOU paid advocate Masembe

8% collection fees. For what? It became apparent that impunity had come to manage BOU. But fate is a great joker, it always laughs last. Those who thought they were above the law will soon realise that this is not the case and none of them can escape the long arms of the law. The wheels of justice may turn slowly in Uganda but eventually they will catch up with the thieves.

The writer is a journalist and current affairs analyst

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article