The Government of Kenya has formally invited Ugandan investors, institutions, and oil marketing companies to participate in the landmark Initial Public Offering (IPO) of the Kenya Pipeline Company (KPC), reinforcing the strong bilateral ties between Kenya and Uganda and their shared commitment to regional energy security and economic integration.

The invitation was issued during a high-level engagement with Uganda’s energy sector leadership and private sector stakeholders as part of Kenya’s regional investor outreach for the KPC IPO, currently open at the Nairobi Securities Exchange (NSE).

The IPO will see the Government of Kenya divest 65 per cent of its shareholding in KPC, one of East Africa’s most strategic energy infrastructure companies. It is the largest IPO in Kenya’s history and the first fully electronic IPO at the NSE, opening ownership to Kenyan, regional and international investors.

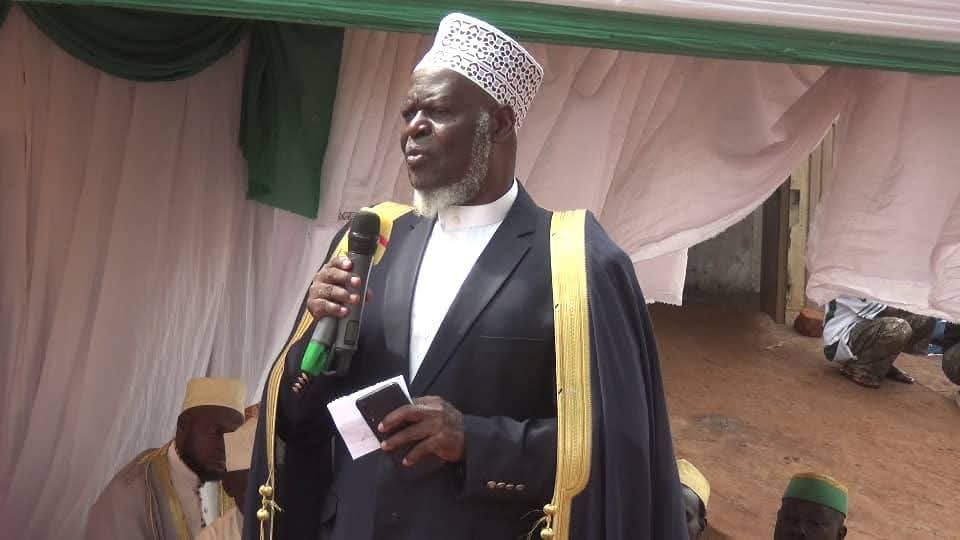

Speaking in Kampala, Hon. John Mbadi, Cabinet Secretary for the National Treasury and Economic Planning of Kenya, underscored the importance of Uganda as a trusted economic partner and a natural co-owner of the Kenya Pipeline Company.

“Uganda is a key economic ally of Kenya and a strategic partner in our shared infrastructure ecosystem. Our pipeline, ports, and transport corridors have strengthened competitiveness for both our countries and unlocked trade across the region. Through this IPO, we are extending a formal invitation to Uganda to partner with us in the ownership of Kenya Pipeline Company and jointly steward its next phase of growth,” said CS Mbadi.

He noted that the IPO is anchored in Kenya’s broader economic reform agenda and the need to mobilise long-term capital for infrastructure without over-reliance on public debt. “By listing KPC, we are broadening ownership, strengthening governance, and enabling the company to access capital markets to fund commercially viable investments that enhance energy security and stabilise fuel supply and pricing across the region,” he added.

Uganda has been allocated a significant stake of 20 percent of the shares in the transaction under the East African Community investor allocation, reflecting its role as one of KPC’s largest regional markets. Over 90 per cent of Uganda’s petroleum imports are supplied through KPC’s infrastructure, with volumes continuing to grow, driven by infrastructure expansion and developments linked to crude oil production.

Uganda remains one of KPC’s most important regional markets, with petroleum demand growing steadily, driven by infrastructure expansion and developments linked to crude oil production. In the last five years, deliveries to Uganda have recorded a compound annual growth rate of approximately 9 per cent, with volumes projected to continue rising into 2026. The IPO is also expected to support future investments that directly benefit Uganda, including capacity expansion in Western Kenya, enhanced storage at Kisumu, operationalization of the Kisumu Oil Jetty on Lake Victoria, and ongoing feasibility work for the proposed Eldoret–Kampala petroleum pipeline.

Welcoming the opportunity, Irene Batebe, Permanent Secretary, Uganda Ministry of Energy and Mineral Development, said the IPO aligns with Uganda’s long-term energy and industrialization goals. “Uganda’s energy security is closely linked to reliable regional infrastructure. Kenya Pipeline Company is central to our petroleum supply chain, and this IPO gives Ugandan institutions and businesses a rare opportunity to invest directly in infrastructure that supports our economy, lowers logistics costs, and strengthens regional resilience,” said Batebe.

Also speaking, Dr. Janerose Omondi, Acting Managing Director and Chief Executive Officer of the Privatization Authority of Kenya, emphasized the regional value proposition of the transaction.

“This IPO is not just a Kenyan transaction; it is a regional one. Uganda is a critical partner in KPC’s operations and future expansion. By participating, Ugandan investors can co-own an asset that supports trade, enhances supply stability and unlocks long-term value for East Africa,” said Dr. Omondi.

Proceeds from the IPO will accrue to the Government of Kenya and be applied in line with national budget priorities, including energy, transport, and other strategic infrastructure investments. The offer opened on 19 January 2026 and will close on 19 February 2026, with listing and commencement of trading expected in March 2026, subject to regulatory approvals. Ugandan investors can participate through authorised selling agents and licensed stockbrokers in accordance with applicable capital markets regulations.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article