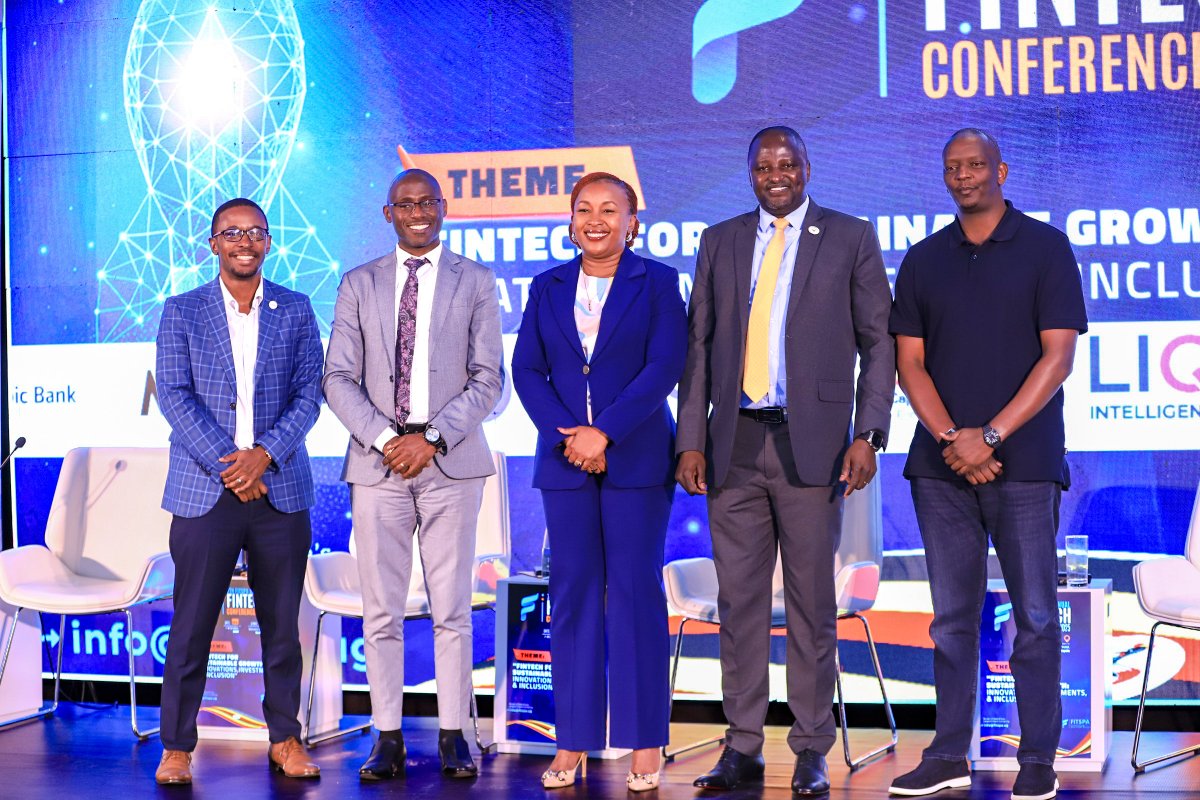

The 7th FITSPA Annual Fintech Conference, held on Tuesday at the Sheraton Kampala Hotel under the theme “Fintech for Sustainable Growth: Innovations, Investments & Inclusion,” brought together Africa’s foremost financial technology leaders, innovators, and regulators for an intensive dialogue on shaping the continent’s digital future.

The event, powered by MTN Uganda and its Mobile Money service (MoMo by MTN), showcased the transformative potential of fintech when guided by purpose, security, and collaboration.

The summit featured a high-profile fireside chat titled “Navigating New Frontiers as Architects of Transformation,” which convened industry heavyweights including MTN Uganda CEO Sylvia Mulinge, MoMo CEO Richard Yego, and M-Pesa Africa MD Sitoyo Lopokoiyit, moderated by Peter Kawumi of Interswitch East Africa. The discussion highlighted the role of fintech not merely as a sector but as a key driver of Africa’s economic inclusion and digital empowerment.

A central theme of the conversation was the importance of purpose-driven leadership in transforming traditional business models into tech-centric enterprises. Mulinge outlined MTN Uganda’s journey from a conventional telecommunications company to a fully integrated technology provider. She emphasized that transformation is most successful when it is intentional and designed with a clear “why.”

“You have to lead by design, not by default. Build a business that’s deeply rooted in your purpose. The outcomes you want to achieve come from understanding and committing to your mission,” Mulinge said. She challenged fintech innovators to align their solutions with Uganda’s national development strategies, encouraging them to ask: “What role does your innovation play in advancing the Government’s 10x growth strategy?”

The conference placed significant emphasis on trust and security, particularly in an era where cyber threats and mobile money fraud are rising concerns. Yego stressed that innovation alone is insufficient without a foundation of trust, stating, “What we offer our customers is trust. Without it, the entire system collapses.”

To combat fraud and enhance security, MoMo continues to invest in advanced technologies and robust processes, ensuring that mobile financial services remain safe, reliable, and transparent. The discussion reinforced that sustainable fintech growth depends on protecting consumers while delivering efficient financial solutions.

The dialogue also highlighted that true innovation extends beyond product development. Mulinge and Yego underscored that fintech must prioritize meaningful customer experiences that deeply connect with users and positively impact their daily lives.

Mulinge stated, “Innovation must be about designing experiences that matter, that truly make a difference in people’s lives.” Yego echoed this by emphasizing that every service and interaction should begin with a thorough understanding of the customer’s needs. This approach, they argued, ensures products are not only functional but transformative in fostering financial inclusion.

Reimagining Africa’s Fintech Potential

Adding a strategic perspective, Lopokoiyit challenged participants to rethink Africa’s fintech narrative. He encouraged leaders to look beyond current paradigms and recognize Africa’s potential to gain a competitive edge in the global digital economy. He argued that deliberate strategic choices today could position African fintech as a model of innovation, inclusion, and growth for the world.

The conference demonstrated that sustainable fintech growth is a collective endeavor, requiring collaboration among startups, regulators, investors, and established industry players. Speakers highlighted that shared vision, alignment with national priorities, and a commitment to inclusion are critical to unlocking Africa’s economic potential.

The two-day 7th FITSPA Annual Fintech Conference concluded on Wednesday with a renewed focus on purpose-driven innovation, customer-centric design, and secure, inclusive financial services.

By bringing together Africa’s brightest minds and fostering dialogue on innovation, security, and inclusivity, the summit reinforced Uganda’s position as a regional fintech hub and showcased the continent’s potential to lead in digital financial transformation.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article