In a jaw-dropping revelation, Uganda’s insurance sector has catapulted to new exciting heights, leaving jaws agape and calculators trembling!

The Insurance Regulatory Authority of Uganda (IRA) unveiled a mind-boggling 17% surge in underwritten premiums, soaring from a staggering Shs 711.6 billion in Q2 2022 to an eye-watering Shs 828.9 billion in the same period of 2023.

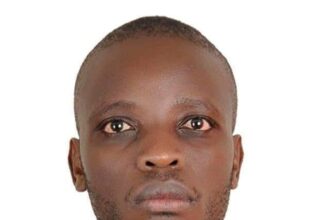

Kaddunabbi Ibrahim Lubega, the awe-inspiring CEO of IRA, declared that this monumental growth stands as a testament to the sector’s magnetic pull, luring in swarms of eager customers and savvy businesses with pockets brimming with gold.

In a thunderous proclamation, Lubega underscored that insurance is nothing short of a sacred vow to shield against life’s unrelenting blows, a promise to mend the wounds of unforeseen calamities.

The non-life insurance juggernaut bulldozed through the financial landscape, amassing a mind-blowing Shs 510.1 billion by June’s end 2023! This colossal feat dwarfs even the wildest dreams of Wall Street, marking an astronomical 56.8% of the total premiums from the same segment in all of 2022!

Meanwhile, the life insurance titan flexed its muscles, raking in Shs 291 billion, a seismic surge from the paltry Shs 147.3 billion in the first quarter of 2023! A monstrous 58% of the total life premiums of 2022 bowed before this staggering figure, leaving competitors quaking in their boots.

In a health-focused crescendo, Health Maintenance Organizations (HMOs) orchestrated an electrifying symphony, raking in a mind-numbing Shs 27.3 billion, up from a modest Shs 16.6 billion in the preceding quarter.

This meteoric rise of 71.3% from 2022 is a clarion call to the industry, heralding the dawn of an era dominated by health-conscious giants!

Microinsurance, the David among these Goliaths, punched above its weight with a colossal Shs 462.63 million, a jaw-dropping 45.8% surge from its 2022 counterpart, leaving critics eating their words!

In a mind-boggling market composition, non-life insurance claimed a titanic 61.6% share of the industry’s colossal premiums, while life insurance held its head high with 35.1%, leaving other classes to bask in the leftover glory.

And if that were not enough, the intermediaries stepped onto the grand stage, brokers snatching a heart-stopping Shs 257.8 billion, a dazzling ascent from the modest Shs 133.6 billion in the first quarter of 2023! Bancassurance played its part with gusto, boasting a thunderous Shs 83.6 billion, a heart-stopping 34.5% surge, contributing a formidable 10.1% to the industry’s total premium!

As the dust settles on this seismic revelation, Kaddunabbi’s gaze remains fixed on the horizon, with plans to further expand the insurance empire.

Ugandans should therefore brace themselves for the onslaught of life insurance magnates, the maritime guardians, the motor titans, and the public sector behemoths, all converging in a symphony of financial might that will echo through the ages. Uganda, stands on the precipice of financial glory.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article