As a way of preventing their economies from collapsing due to the Covid-19 pandemic, so far three East African countries have already acquired foreign loans.

In a period of three months since recording the first Covid-19 case in East Africa- (in Kenya) on March 13 2020, the region has borrowed over USD2.3bn (Shs 8.71trillion) from western donors especially the International Monetary Fund (IMF), European Union and the USAID.

Loans have so far been taken by Kenya, Uganda and Rwanda. Other countries like Tanzania, South Sudan and Burundi have not announced their intentions for the loans despite the fact that they have also been hit by Covid-19.

Out of the six members of East African Community (EAC), Kenya has borrowed the biggest percentage of money estimated to be USD 1.5billion, Uganda currently has borrowed USD 540.2 million and Rwanda is in third place having borrowed USD 223.5 million.

According to experts, if all members of EAC get loans, the debt burden in the region is to increase by a bigger margin. Before Covid-19, East Africa had a debt of USD110bn but right now it has USD113.3bn.

Who are the lenders?

The first lender to Kenya was IMF- USD739m, World Bank-USD6.6m, and USD20m from private individuals.

For the case of Uganda in April it received the first loan of Shs122bn from European Union purposely for health emergency response, USAID-Shs7.5bn, Shs13.5bn, and Shs24.8 for Hospital preparations, Health and Refuges and Covid-19 responses respectively. Denmark-Shs2.1m for Covid-19 response.

In May Uganda received a loan of Shs8.6bn from USAID for risk communication case management. Shs1.9trillion from IMF for economic impact.

Rwanda received USD109.4m from IMF to deal with foreign exchange pressure. USD14.5m, from International Development Association (IDA) for Covid-19 emergency response and USD100m from World Bank to support their budget.

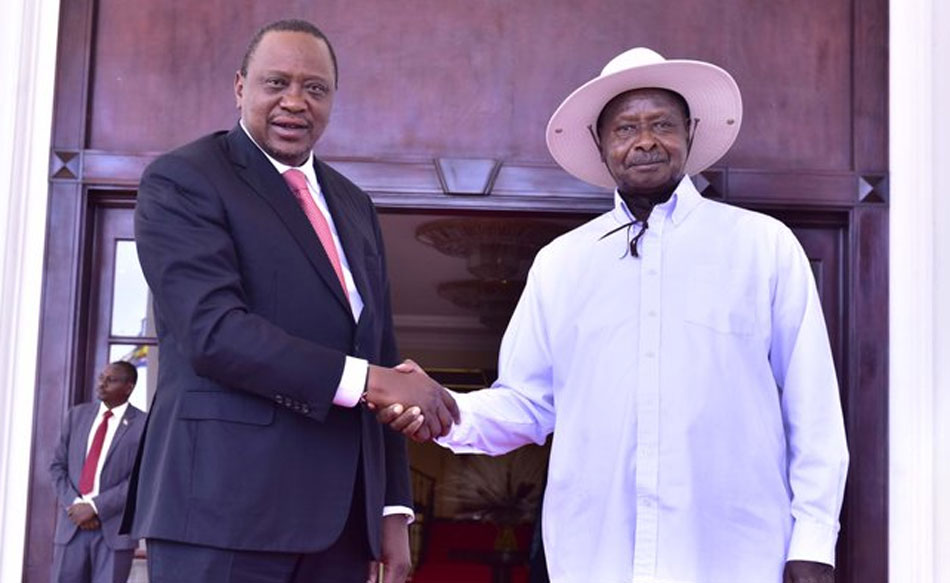

The impact of this huge new debt is presumed to be greatly felt since East African local currencies are going to be under pressure due to the current statuses of the economies which will cause their depreciation speedy thus making debt repayments too expensive. However to avoid these expensive debt repayments .EAC heads are applying for foreign debt repayment holidays in order to first build sphincters of their economies back which had been destroyed by the Covid-19.

However, the loan leaves Uganda alone in a bad situation since her debt to Gross Domestic Product ratio is soon reaching 50 per cent beyond which the IMF may find difficult to lend money to the East African country again.

Yet in East Africa, Uganda has been standing in good sharp as per the EAC agreement on debts ratios which provides that members state countries must not exceed 50 per cent. As per IMF statistics Kenya, Tanzania, Burundi and Rwanda are highly exposed to the margin.

Before Covid-19 Kenya had already surpassed the limit of 50 per cent and currently stands at 60 per cent to GDP since it’s total debt is USD60bn. Before Covid-19 as of January 30, 2020, Uganda’s debts stood at USD13bn (Shs49.75trillion) which is about 36.5 per cent.

However, experts have warned EAC presidents not to rush into accumulating loans yet their economies are not in good sharp, Also Tanzania President John Pombe Magufuli’s move of calling for the cancellation of all foreign debts could be his surgical step to save his country from the benevolent Western donors.

Do you have a story in your community or an opinion to share with us: Email us at Submit an Article