In the turbulent waters of global economics, where currencies wobble and inflation lurks like a shadow, Uganda stands as a beacon of prudent stewardship.

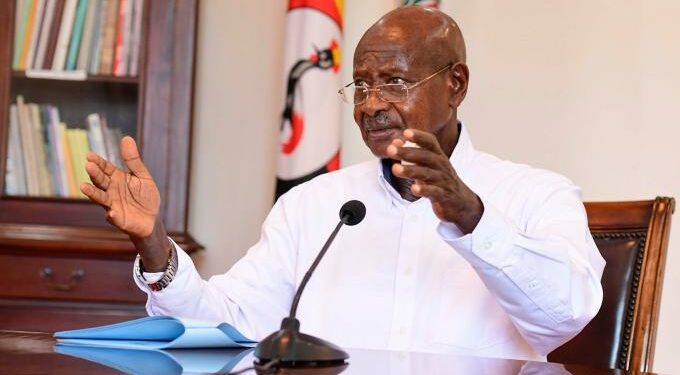

Under President Yoweri Museveni’s watchful eye, the teams at the Bank of Uganda (BoU) and the Ministry of Finance have orchestrated a symphony of stability and growth that deserves resounding applause. As we mark October 28, 2025, key economic pillars—from the resilient Ugandan shilling to controlled inflation and robust GDP expansion—paint a picture of foresight and resilience. This is not mere luck; it’s the fruit of deliberate policy-making that has shielded ordinary Ugandans from the tempests battering emerging markets elsewhere.

Consider the shilling, often the canary in the coal mine for economic health. Throughout 2025, the Ugandan shilling has held its ground with admirable poise against the U.S. dollar, averaging 3,610 UGX per USD—a testament to the BoU’s vigilant interventions in forex markets. The currency even flashed strength, dipping to a favorable 3,412 UGX per USD on October 11, marking one of its best performances this year. As of today, it trades at 3,479.51 UGX per USD, up a modest 0.01% from the prior session, defying depreciation pressures seen in peers like the Kenyan shilling. In a year when many African currencies have depreciated amid global rate hikes and commodity volatility, this stability has kept import costs in check, curbing the pass-through to consumer prices. Exporters, too, benefit from predictability, fostering confidence in sectors like coffee and gold. The Ministry of Finance’s complementary fiscal discipline—balancing external inflows with domestic resource mobilization—has been pivotal, ensuring the shilling isn’t adrift in speculative seas.

Monetary policy under BoU Governor Michael Atingi-Ebettu has been a masterclass in calibration. The Central Bank Rate stands firm at 10.25%, a tight stance that has anchored inflation without stifling growth. Headline inflation eased to 4.0% in September 2025, up slightly from 3.8% in August but well within the BoU’s 5% target band—the lowest in over a year and a far cry from the double-digit spikes of yesteryears.

Core inflation, stripping out volatile food and energy, mirrors this at 4.0%, signaling broad-based price discipline. Treasury bill yields reflect this prudence: 91-day bills at around 10.3%, 182-day at 13.4%, and 364-day at 15.2%, attracting domestic savers and funding government needs without undue pressure on the budget. These tools have not only tamed inflationary ghosts but also supported credit growth to the private sector, fueling investments in agriculture and manufacturing.

On the fiscal front, the Ministry of Finance has navigated debt with agility amid ambitious infrastructure drives. Public debt reached Shs116.2 trillion by June 2025, equivalent to 51.3% of GDP—a 26% surge from the prior year driven by domestic borrowing to finance deficits.

Yet, the government insists it’s sustainable, with 56% of external debt concessional at low rates, minimizing repayment burdens. Debt servicing remains manageable at under 20% of revenues, thanks to diversified funding and prudent rollovers. This stability underpins Uganda’s stellar GDP growth: a robust 6.3% for the 2024/25 fiscal year, accelerating from 6.1% the previous year, with Q2 2025 clocking 5.5% year-on-year. The IMF projects 6.4% for the full year, propelled by services, construction, and agro-processing—sectors that employ millions and promise inclusive prosperity.

At the heart of this success lies President Museveni’s visionary economic philosophy, which he has tirelessly championed. He has emphasized that Uganda isn’t a supermarket—mindlessly importing what it can produce domestically—but a nation poised for self-reliance through domestic production, value addition, and import substitution.

In recent addresses, Museveni has lambasted Africa’s “buy-and-do-not-produce” crisis, urging leaders to prioritize agro-industrialization and ban imports of surplus local goods like maize or milk. His push for value addition in coffee, iron ore, and fisheries has borne fruit: manufactured exports surged 72% to $1.1 billion in April 2025 alone. By expanding markets via the African Continental Free Trade Area and bolstering infrastructure, Museveni ensures Uganda doesn’t just consume but creates wealth. This bottom-up approach—rooted in the Parish Development Model—has lifted rural economies, reduced import dependency, and fortified forex reserves against shocks.

Critics may point to debt’s creep or occasional inflationary blips, but these are growing pains in a transformation story. Uganda’s reserves cover over five months of imports, and fiscal buffers shield against global headwinds like U.S. tariffs or climate disruptions.

As Museveni’s teams at BoU and Finance press on, blending orthodoxy with bold innovation, Uganda’s trajectory is upward. For a nation of innovators—from Kampala’s tech hubs to Karamoja’s resilient farmers—this is more than policy; it’s a promise kept. In an era of uncertainty, Uganda’s steady hand inspires: stability today, sovereignty tomorrow.

Do you have a story in your community or an opinion to share with us: Email us at editorial@watchdoguganda.com